Renting vs. Mortgage: Which option is more profitable in 2026?

We explain with practical examples and updated figures how to calculate whether it is better for you to rent or take out a mortgage, and how to maximize the profitability of your investment in 2026.

If you're thinking about moving or buying a home, you've probably wondered: is it better to rent or buy in 2026? There's no single answer; it depends on your income, your life plans, and the real estate market in your city. However, if we analyze real figures and compare costs in different Spanish cities, we see that buying a home is usually more profitable than renting if done intelligently and with careful planning.

We know that this decision not only affects your day-to-day life, but also your long-term finances, and that's why at aFinance we want to help you make the best decision according to your personal and financial profile.

1. Current situation of the real estate market

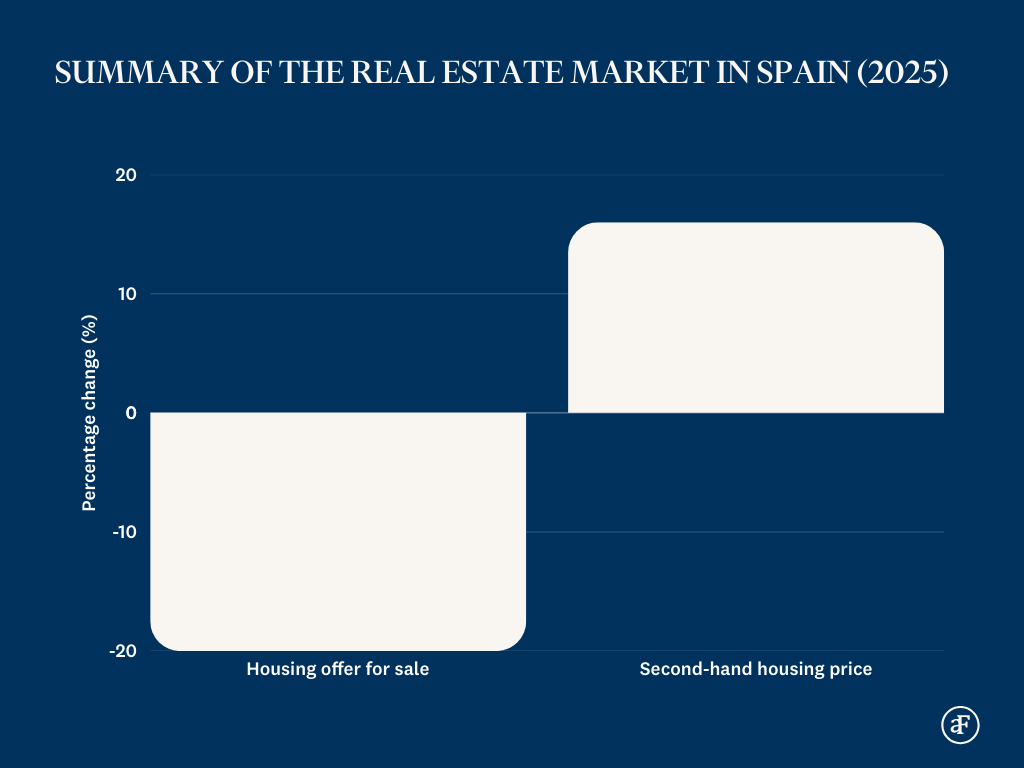

In Spain, the supply of rental housing has decreased in recent years. According to industry sources, the available stock has been significantly reduced as landlords opt for other rental options or withdraw their properties from the market. At the same time, the availability of homes for sale contracted by around 20% in the first half of 2025 compared to the same period in 2024, one of the largest historical drops recorded on real estate portals, which increases competition among buyers.

This shortage of supply coincides with sustained growth in demand and strong pressure on prices, as second-hand housing prices have risen by more than 16% in 2025, and rents continue at historically high levels, reflecting the strong tension between limited supply and growing demand.

In this context, the final choice should always be based on your financial situation, your needs, and above all, your lifestyle. In any case, the key is to carefully weigh all the factors and seek professional advice to resolve any doubts.

At aFinance we can help you. Request your free pre-study and in less than 24 hours you will know what your best purchase options are.

REQUEST YOUR FREE PRE-STUDY HERE

2. Why buying is usually the best option

While renting may seem convenient and flexible, every euro you pay doesn't translate into equity. Buying a home, on the other hand, allows you to:

✔️ Build wealth that appreciates while you live in your home.

✔️ Have long-term security without depending on rent increases.

✔️ Plan your future with economic stability and peace of mind.

Furthermore, if you are under 35 years old you can access ICO guarantees for the purchase of your first home, a State aid that guarantees up to 20% of the purchase price, making it easier for young people to access their first home without needing large prior savings.

If your goal is to start building wealth and find the perfect home, our Real Estate Personal Shopper at Grupo aFinance will guide you through the entire process: we find the property that fits your preferences and coordinate every step with your mortgage manager to ensure a quick, secure, and worry-free purchase.

Find your ideal home with the best financing

CONSULT YOUR REAL ESTATE PERSONAL SHOPPER

On the other hand, if your goal is to have flexibility, mobility and avoid long-term financial ties, renting may be a better fit for your lifestyle.

3. Monthly comparison: renting vs buying

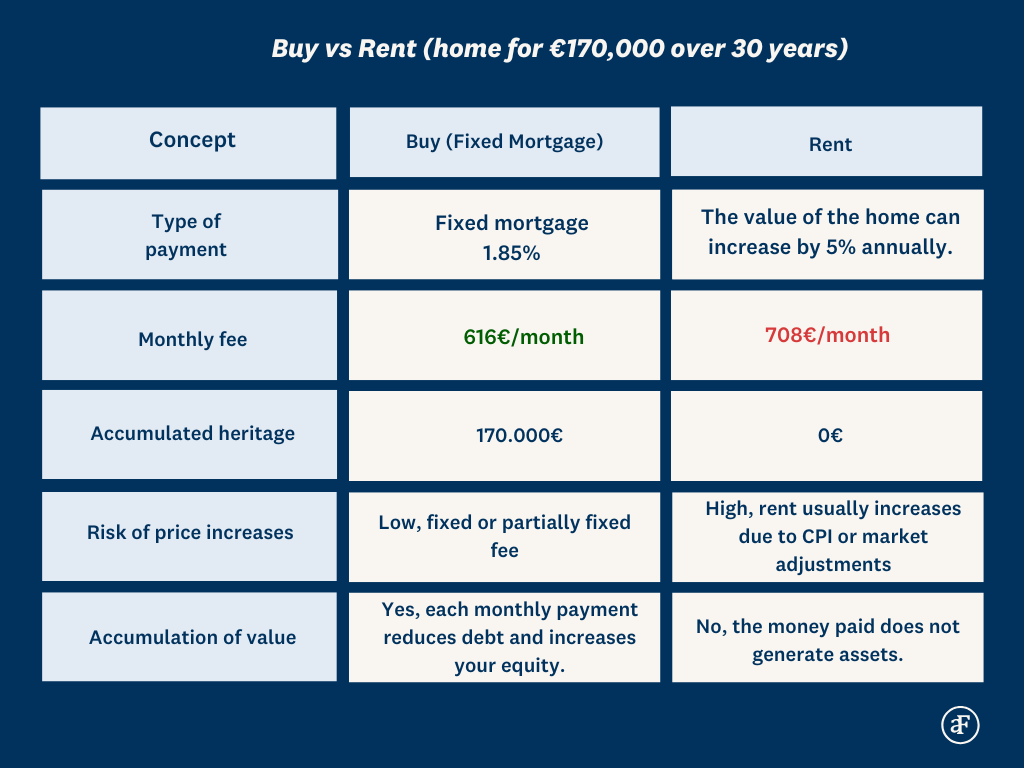

Next, we will analyze, using real market data, the economic difference between renting and buying a home with a mortgage.

To calculate the rental price, we use the national average and a common criterion in real estate analysis: a gross rental yield of between 4.5% and 5.5% annually on the property's value. This reflects a "normal" market rent, excluding extreme areas and specific cases. This calculation assumes a fixed rent throughout the entire period, which is unusual in practice, as rental prices typically increase each year due to inflation or market adjustments. This means that even if you pay "X" euros today, in 5, 10, or 20 years you will be paying more, and that money won't become equity.

In contrast, with a mortgage your monthly payment can be fixed (or partially fixed), and although at the beginning you pay more interest than principal, each month you are paying off part of the property. Over time, the interest you pay decreases and most of the monthly payment goes toward ownership:

The conclusion is clear: with rental prices in recent years, buying a home represents a long-term investment that generates a profit for the buyer and an asset value that grows each year. This is not the case with renting, since at the end of the analyzed period, the expense remains the same month after month.

Want to start investing in your future? Find out what your mortgage payment would look like.

Calculate your personalized monthly payment with our simulator:

- Featured news

-

What does a mortgage broker do and how can they help you save thousands of euros?October 3rd 2025

What does a mortgage broker do and how can they help you save thousands of euros?October 3rd 2025 -

100% Mortgage in 2025: how to get a home without savingsSeptember 29th 2025

100% Mortgage in 2025: how to get a home without savingsSeptember 29th 2025 -

Get your ideal mortgage with expert help and better termsAugust 10th 2025

Get your ideal mortgage with expert help and better termsAugust 10th 2025 -

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024 -

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024