100% Mortgage in 2025: how to get a home without savings

mortgage-100-without-savings

We explain in detail what a 100% mortgage is, how it works, what requirements you must meet and what its main advantages are.

Buying a home is one of the biggest financial challenges, especially due to the need to save up for the down payment and associated expenses. For many young people and families with stable jobs but without enough savings, this first step can become the biggest obstacle.

With a 100% mortgage, you can own your home without needing any upfront cash. At aFinance, we help you get one, negotiating the best terms so you can achieve your dream of homeownership quickly and securely.

What is a 100% mortgage?

This type of mortgage loan fully covers the purchase price of the property. Unlike traditional mortgages (which typically finance a maximum of 80% of the appraised or purchase value), this option eliminates the need for an initial down payment from the buyer.

In other words, it is a mortgage without the need for prior savings, which makes it a particularly attractive alternative for those who want to access a home without having to wait years to accumulate the necessary capital.

Do you want to know if you can get a 100% mortgage without savings?

5 advantages of a mortgage without savings

Opting for a 100% mortgage offers several benefits such as:

✔️Immediate access to housing: no need to wait years to save for a down payment.

✔️Ability to take advantage of market opportunities: buy at the right time without depending on prior savings.

✔️Flexibility for young people and families: especially useful for those with stable employment but who haven't accumulated capital.

✔️Negotiated terms: with the help of experts like aFinance, it's possible to obtain better interest rates and more favorable clauses.

✔️Allocate capital for renovations: if necessary, you can use your funds to improve the property.

Requirements to access a mortgage without a down payment

Obtaining a mortgage without savings is a real option, although it requires meeting certain specific criteria. These requirements, somewhat more demanding than for a conventional mortgage, help guarantee the viability of the transaction. Among the most common are:

- Job stability: permanent contract or at least 6 months of seniority with the company.

- Demonstrated ability to pay: income exceeding €1,600/month for one of the applicants.

- Clean credit history: no outstanding debts or entries in credit reporting agencies.

- Guarantees: in some cases, a guarantor or a property free of encumbrances is required.

How to get a 100% mortgage with aFinance

Banks typically limit financing to 80% to reduce risk. The remaining 20%, along with notary, registration, and tax expenses, must be provided by the buyer. This ensures the financial institution that the client is genuinely committed to the transaction and can afford the payments.

However, there are situations where it's possible to get a mortgage with no down payment, and this is where aFinance's experience in negotiating these deals comes into play. With over 20 years of experience and a volume of more than 20,000 transactions submitted to banks annually, aFinance works with all banking institutions to secure the lowest interest rate on the market for your 100% mortgage.

Banks that offer 100% mortgages do exist, but the key is knowing how and with whom to negotiate. At aFinance, we have experience managing complex mortgages and negotiating preferential terms. Thanks to our transaction volume and exclusive agreements with banks, we can help you obtain a mortgage with no down payment and more competitive terms.

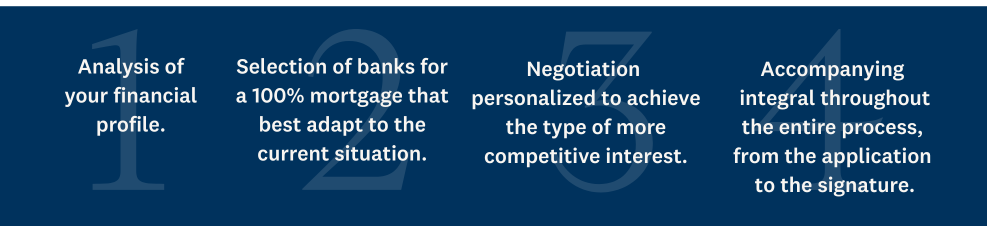

Our process is based on:

If you dream of owning your home with a mortgage that perfectly suits your needs, at aFinance we'll help you make it a reality.

Start today and get your mortgage with no down payment:

- Featured news

-

Renting vs. Mortgage: Which option is more profitable in 2026?January 8th 2026

Renting vs. Mortgage: Which option is more profitable in 2026?January 8th 2026 -

What does a mortgage broker do and how can they help you save thousands of euros?October 3rd 2025

What does a mortgage broker do and how can they help you save thousands of euros?October 3rd 2025 -

Get your ideal mortgage with expert help and better termsAugust 10th 2025

Get your ideal mortgage with expert help and better termsAugust 10th 2025 -

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024 -

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024