What does a mortgage broker do and how can they help you save thousands of euros?

How to get the most profitable mortgage, take advantage of subsidies and simplify the entire financial process with the help of experts

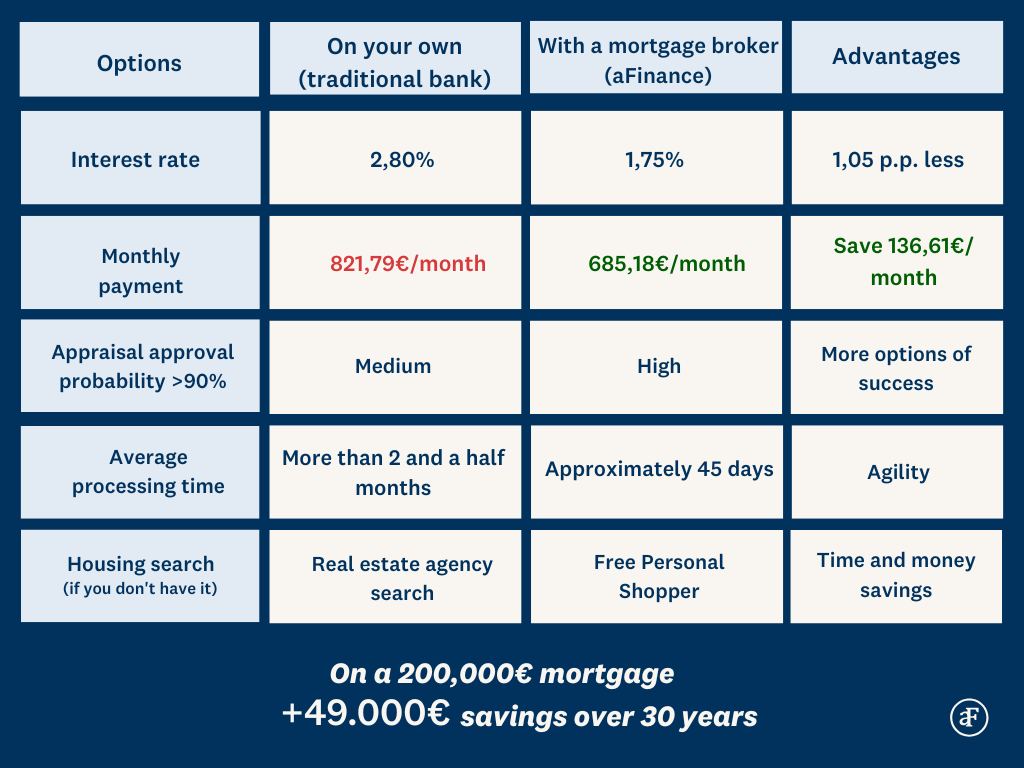

Did you know that going directly to a bank limits your mortgage options? Each institution has its own terms, fees, and approval criteria. On the other hand, using a mortgage broker allows you to save thousands of euros by accessing better interest rates and, in many cases, obtaining a mortgage that you wouldn't get on your own.

His experience and market knowledge allow him to identify the most competitive mortgages, anticipate the requirements of each entity, and access exclusive offers that are not available to the general public.

How a mortgage broker works to get you the best mortgage

The added value of a mortgage broker goes far beyond simply comparing offers. This professional simplifies the entire process and advocates for your interests with the banks. They guide you every step of the way, answer your questions, expedite procedures, and help you make informed decisions, avoiding mistakes that could cost you time and money.

And this is where aFinance makes the difference. With over 20 years of experience in the sector and a team of more than 200 professionals, we work exclusively for you—not for the banks—with the goal of securing the most profitable mortgage tailored to your needs.

At aFinance, we analyze your financial situation individually, comparing dozens of mortgages from different banks and negotiating on your behalf to obtain the lowest interest rate and the most favorable financing. Furthermore, we guide you through the entire mortgage process, ensuring a safe and transparent experience.

Discover everything aFinance can do for you!

Differences between looking for a mortgage on your own or with a mortgage broker

When looking for a mortgage, it's key to know all the advantages of having a mortgage broker, who can help you get better terms and reduce the total cost, instead of doing it on your own:

With a mortgage broker like aFinance, you not only expand your options and access better terms, but you also save time and money. Our team manages the entire process, from the free consultation to signing, including subsidies, guarantees, and renovations, ensuring a more profitable mortgage without surprises.

aFinance's 360º services: the comprehensive solution for your mortgage

At aFinance, we offer a comprehensive mortgage brokerage service designed to guide you through every stage of the financial and real estate process. Our 360º approach allows you to not only secure the most competitive mortgage but also access subsidies, guarantees, and additional services that make buying a home easier.

Our featured services include:

✔️ Purchase + Renovation Mortgage, this mortgage combines the financing of both the purchase and renovation of a home into a single loan, optimizing monthly payments and simplifying the process.

✔️ Real Estate Personal Shopper, an exclusive and free service where we find and negotiate your ideal home based on your criteria for location, budget, and preferences.

✔️ Young Person's Mortgage: With ICO guarantees and regional subsidies, this mortgage is designed for young people under 36 who are looking to buy their first home. Thanks to our in-depth market knowledge, at aFinance we secure the best available terms and subsidies in each region.

✔️ Mortgages for non-residents, offering solutions for those living outside of Spain who wish to invest in or purchase property in the country.

✔️ Mortgage refinancing or improvement, reducing interest rates and fees, and improving the flexibility of current loans.

✔️ Debt consolidation, combining loans into a single, more manageable and affordable monthly payment.

✔️ Termination of joint ownership, managing the legal and financial separation or allocation of shared properties.

✔️ Refinancing a home, to obtain additional liquidity or finance personal projects with competitive terms.

Thanks to our comprehensive approach, at aFinance we combine experience, bank negotiation, and professional management to offer you the most favorable mortgage, maximize your access to government subsidies, and ensure you enjoy the process without stress. Want to know more?

DISCOVER YOUR MOST PROFITABLE FINANCING OPTION

- Featured news

-

Renting vs. Mortgage: Which option is more profitable in 2026?January 8th 2026

Renting vs. Mortgage: Which option is more profitable in 2026?January 8th 2026 -

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024 -

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024 -

En aFinance participamos en el Evento ‘Comunicación Eficaz’ en Roca Barcelona GalleryMay 25th 2024

En aFinance participamos en el Evento ‘Comunicación Eficaz’ en Roca Barcelona GalleryMay 25th 2024 -

En aFinance, nos complace anunciar la incorporación de Patricia Marqués como Coach EjecutivaMay 23rd 2024

En aFinance, nos complace anunciar la incorporación de Patricia Marqués como Coach EjecutivaMay 23rd 2024