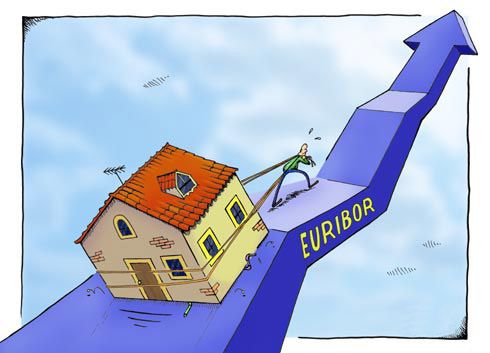

The 12-month Euribor is one year in negative

The index to which most Spanish mortgages are referenced has completed its first year in negative monthly rate and will close the next February to -0.105%.

The index to which most Spanish mortgages are referenced has completed its first year in negative monthly rate and will close the next February to -0.105%.

In daily rates, the index deepened its fall throughout February and was placed at -0.113% last Friday. In the absence of two days to close the month, the Euríbor stands at -0.105% in monthly rate, which is 0.097 points less compared to February last year.

In this way, 20-year mortgages with a Euríbor + 1% spread to which they will review will have a discount of € 5.17 per month or € 62.04 per year.

Although the index is deepening in its historical lows, the declines are becoming smaller, although the experts do not augur, for the moment, a rebound in the short term. "In the medium term we think that the bearish travel of the Euríbor is scarce," said XTB analyst Carlos Fernández.

The expert explained that the excess liquidity provided by the European Central Bank (ECB) and the low interest rates have been the main cause of the Euríbor has remained a year in negative territory.

However, it points out that data such as the interest rate of fixed rate mortgage loans are anticipating a change in the index's trend. "Throughout the month of February there have been several financial institutions that have started to raise interest rates on their fixed mortgages, indicating a clear change of trend with respect to previous months," he said.

For this reason, the analyst says that if we take these factors into account and the fact that "it does not make much sense" to see the Euribor in negative terms, "it is natural to think that it starts to rebound in months and that it Levels greater than 0 ".

Taking into account this context, Bankinter analysts expect the index to be -0.07% at the end of the first quarter of the year, -0.05% in the second quarter and -0.03% in the third quarter , To close the exercise in 0.05%, a value that also has in its calculations Sabadell.

The Euribor Plus is expected to be operational during the first half of the year, which will replace the current 12-month Euribor as the reference index for mortgage loans and will improve the current benchmark.

Faced with the prospect that the Euríbor will begin to rebound this year, experts predict a rise in mortgages at variable rates in the coming years. In fact, the unstoppable fall of the Euríbor has led banks to bet especially since 2016 on fixed rate versus variable rate.

- Featured news

-

Renting vs. Mortgage: Which option is more profitable in 2026?January 8th 2026

Renting vs. Mortgage: Which option is more profitable in 2026?January 8th 2026 -

What does a mortgage broker do and how can they help you save thousands of euros?October 3rd 2025

What does a mortgage broker do and how can they help you save thousands of euros?October 3rd 2025 -

100% Mortgage in 2025: how to get a home without savingsSeptember 29th 2025

100% Mortgage in 2025: how to get a home without savingsSeptember 29th 2025 -

Get your ideal mortgage with expert help and better termsAugust 10th 2025

Get your ideal mortgage with expert help and better termsAugust 10th 2025 -

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024 -

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024