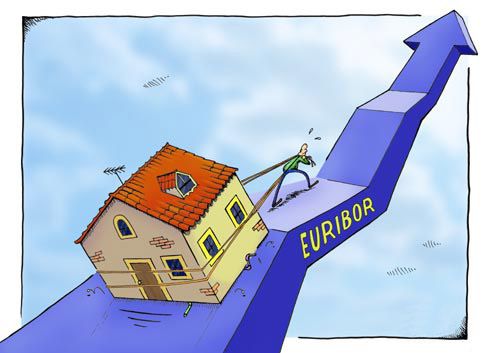

We do not know if with the new Euribor mortgages will be cheaper

The benchmark index in Spanish mortgages is experiencing times of change. Community legislation obliges it to be reformulated, as it is now based on estimates and not actual operations of the interbank market.

The general secretary of the European Money Markets Institute (EMMI), in charge of fixing the Euribor, foresees to have the new type by the end of 2018

The benchmark index in Spanish mortgages is experiencing times of change. Community legislation obliges it to be reformulated, as it is now based on estimates and not actual operations of the interbank market.

Immersed in this process of transformation, the EMMI pilots to have a new Euribor for 2018, but does not finish to define if it will end up being a change that favors the consumers.

There are about ten Eurozone countries that take the Euríbor as a reference. Including Spain, Portugal, Italy or Ireland.

There is European regulation requiring that critical and systemic reference rates should be based on actual operations to the maximum extent possible. The EMMI is intended to be entirely based on these actual operations. That it was not based on expert estimates like so far. But there are not enough transactions so that we can carry out a methodology based entirely on the market.

We studied a combined or hybrid methodology, which would comply with the regulation. On the one hand the entities look at their own operations. If they are not enough they look at similar markets. If they are still not enough, the trial of an expert comes into play, so it is a hybrid. You need proof to see if it's sturdy enough to launch. It will be consulted to those involved: banking, financial institutions, consumers ... By the end of 2018 you want to have everything ready.

In any case, the new Euribor will be ready for when the market recovers. One of the reasons to change the Euribor is to make it more transparent. Entities now self-enforce the rules. It also takes stock of the current situation of the banks. Great players are needed in Europe to compete with fintechs or big corporations - Amazon, Facebook - to start giving financial services. In reference to the banking crises, the risk is always there, but with stronger entities they face better.

- Featured news

-

Consigue tu hipoteca ideal con ayuda experta y mejores condicionesAugust 11th 2025

-

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024 -

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024 -

En aFinance participamos en el Evento ‘Comunicación Eficaz’ en Roca Barcelona GalleryMay 25th 2024

En aFinance participamos en el Evento ‘Comunicación Eficaz’ en Roca Barcelona GalleryMay 25th 2024 -

En aFinance, nos complace anunciar la incorporación de Patricia Marqués como Coach EjecutivaMay 23rd 2024

En aFinance, nos complace anunciar la incorporación de Patricia Marqués como Coach EjecutivaMay 23rd 2024 -

En aFinance hemos superado los 1.150 millones de euros en valor de transacciones durante 2023May 3rd 2024

En aFinance hemos superado los 1.150 millones de euros en valor de transacciones durante 2023May 3rd 2024