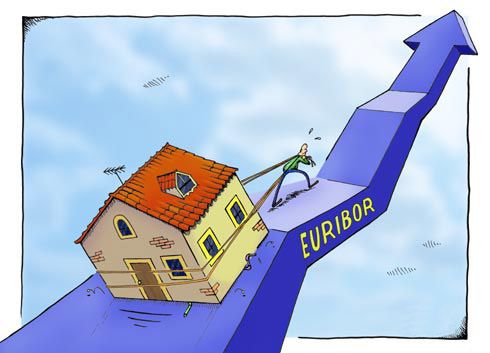

The euribor rises to -0.179% but still lowers mortgages

The final data for July will make it possible to lower the average mortgage to which it will be revised at 15.24 euros per year.

The euribor closes June at -0.181%

The final data for July will make it possible to lower the average mortgage to which it will be revised at 15.24 euros per year. In a daily rate, the index to which most of the Spanish mortgages are referenced, the Euribor was placed this Tuesday, the last day of the month, at -0.178%, one tenth below the percentage that marks the monthly average, although still above the record of the same month of the previous year, which was -0.154%.

With these values, mortgages of 120,000 euros to 20 years with a differential of euribor + 1% to which they review will experience a reduction of about 15.24 euros in their annual quota or, which is the same, of 1, 27 euros per month. The Euribor entered in February 2016 in negative territory for the first time in history before the ultraexpansive policy of the European Central Bank (ECB) to prop up the recovery in the euro zone, so it has already accumulated two years below 0% .

XTB analyst Rodrigo García believes that, despite these negative levels, it seems that the interbank index of the euro zone continues with its process of anticipating a change in the trend. "After an uninterrupted fall that has lasted more than five years, the euribor rises for the fifth consecutive month," he stressed, adding that since the lows of last February the indicator has only increased, although always in negative terms .

The expert explained that although this is positive for banks, it is not for mortgages, both for those who will see how their mortgages are revised in this period and for those who want to imminently hire a product referenced to the Euribor , be it a mortgage or not. However, Garcia has assured that the impact "is very residual", since it has only gone from -0.191% to -0.179%. "What is important about this is not the amount, but the fact that we have been upwards for five consecutive months," he said.

In the opinion of the analyst of XTB, the factors that are influencing this rebound are the "slight" increase in the demand for credit and, above all, the open door left by the European Central Bank ECB) to direct the euro zone towards a potential monetary normalization.

"From now on, the ECB will once again be a key element, the closer a rate rise is, the more upward movement this indicator will make, anticipating the decision", he pointed out. In this line, Garcia explained that the market is aware that the president of the issuing institute, Mario Draghi, may be living his last months at the head of the ECB and that, therefore, there are certain possibilities, although "very few", of to say goodbye with a rate increase or, at least, a more 'hawkish' message.

- Featured news

-

Consigue tu hipoteca ideal con ayuda experta y mejores condicionesAugust 11th 2025

-

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024

Incorporamos a Carlos Martín como nuevo Director de nuestra oficina de Barcelona en aFinanceSeptember 19th 2024 -

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024

Las finanzas bajo el foco con nuestro Director NacionalSeptember 12th 2024 -

En aFinance participamos en el Evento ‘Comunicación Eficaz’ en Roca Barcelona GalleryMay 25th 2024

En aFinance participamos en el Evento ‘Comunicación Eficaz’ en Roca Barcelona GalleryMay 25th 2024 -

En aFinance, nos complace anunciar la incorporación de Patricia Marqués como Coach EjecutivaMay 23rd 2024

En aFinance, nos complace anunciar la incorporación de Patricia Marqués como Coach EjecutivaMay 23rd 2024 -

En aFinance hemos superado los 1.150 millones de euros en valor de transacciones durante 2023May 3rd 2024

En aFinance hemos superado los 1.150 millones de euros en valor de transacciones durante 2023May 3rd 2024